[ad_1]

WASHINGTON (AP) — A key Federal Reserve official said Tuesday he has “complete confidence” that the Fed’s interest rate policies will succeed in getting inflation back to the central bank’s 2% target level.

Official Christopher Waller, a member of the Fed’s Board of Governors, cautioned that inflation is still very high and that it is not yet certain whether the recent slowdown in price increases can be sustained. But he sounded the most optimistic of any Fed official since the central bank launched an aggressive series of rate hikes in March 2022, and hinted that the central bank could possibly raise rates.

“I am confident that policy is currently well positioned to slow the economy and get inflation back to 2%,” Waller said in a speech at the American Enterprise Institute, a Washington think tank.

Waller’s comments follow Chair Jerome Powell’s More cautious comments Earlier this month, Powell said “we are not confident” that the Fed’s key short-term interest rate was high enough to completely defeat inflation. The Fed has raised its rates 11 times in the past year and a half to about 5.4%, the highest level in 22 years.

Inflation, measured year on year, has fallen from a peak of 9.1% in June 2022 to 3.2% in October. Waller said the October inflation report, which showed prices were stable from September to October, was “what I wanted to see.”

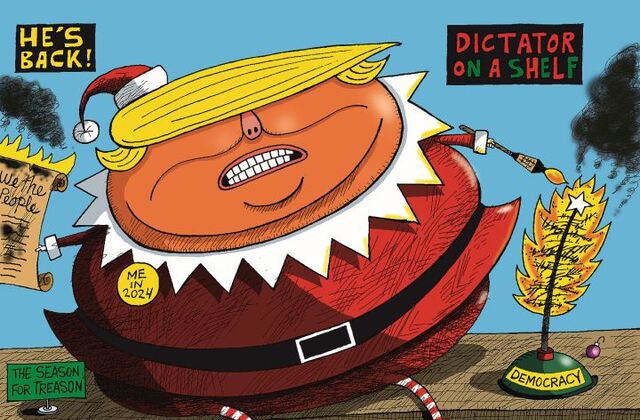

political cartoon

Waller said recent data on hiring, consumer spending and business investment showed that economic growth was slowing from its 4.9% annual pace in the July-September quarter. Slower spending and hiring will help reduce inflation further, he said.

Last month’s figures are “consistent with the softening of demand and lower price pressures that will help get inflation back to 2%, and I look forward to seeing confirmation of that in the upcoming data release,” Waller said.

Copyright 2023 The associated Press, All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

[ad_2]

Source link