[ad_1]

“Financial concerns (for the holidays) are the number one anxiety-causing issue,” said Dr. Petros Levonis, president of the American Psychiatric Association.

Here are experts’ recommendations for reducing financial stress during the holidays:

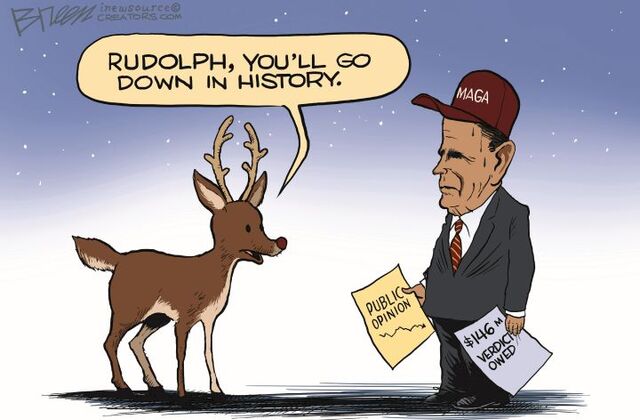

political cartoon

For many families, the holidays mean going out and giving gifts. But this can quickly become stressful if maintaining your finances becomes difficult.

Managing expectations is important, according to Bankrate.com analyst Sarah Foster.

“During the holiday season, we often feel like let’s not talk about money, let’s not tell people how much the gift we bought them cost,” said Foster, who is breaking the taboo by letting go of the taboo. Recommend talking about how much you can give this year.

Levonis said setting a budget can help prevent stress during the holidays.

“Try not to spend more than you can afford. Make a budget and stick to it. “Being with friends is more meaningful for our mental health than the business aspects of this season,” he said.

But not spending during the holiday season, when it seems like everyone is spending so much money on gifts, is easier said than done. If you struggle with overspending, shopping expert Trae Boz recommends setting yourself a spending limit.

Boz recommends writing down a list of your gifts and sticking to it when you go out shopping. If you spend too much buying gifts for yourself, she recommends that you set a specific limit.

“If you say ‘I only have $50 or $100, you’ll spend more thoughtfully’,” she said.

There are many options for spending a lot of money. they include:

Lena Liu, 30, a fellow Massachusetts-based physician, has opted to give homemade bracelets to some of her friends in the past.

“It can be really discreet and it’s really not that expensive,” Liu said. “They know you put your work and your energy into designing the bracelet and getting the beads, so they really appreciate it.”

Gift cards may seem impersonal, but Foster argues that they’re a great way to stay within your budget because you can plan the exact amount you’ll spend on each card.

In recent years, Boz has noticed that young people prefer to give each other experiences rather than gifts. But he suggested that you don’t spend too much on expensive travel, but instead find affordable recreational activities to do with your loved ones.

Examples include going ice skating, hiking, or hosting a potluck. You can also gift a photoshoot or framed pictures or digital albums to commemorate happy experiences.

“It’s something you and your loved ones can experience together and take pictures and enjoy,” Boz said.

If you can’t afford to take your parents on trips or visit them during the holidays, giving them more of your time can be a true gift, Levonis said.

Whether it’s planning a weekly video call with your friend group or calling your grandma every day, non-monetary gifts can go a long way.

Create your own traditions

Expectations or traditions you grew up with, such as buying expensive gifts for each member of your extended family, can cause stress during the holidays. This is what Boz calls “keeping up with the Joneses,” which is trying to meet other people’s expectations instead of being realistic about your spending.

“Sometimes you may have a family member who is very well off financially and they like to do big, extravagant things with you. If you’re not in the same financial situation, you shouldn’t feel obligated to return the favor,” Boz said.

Creating new traditions of your own can help reduce the stress of overspending as you feel pressured. Boz recommends that you suggest something different to your family, friends, or workplace.

Additionally, the holidays can represent a difficult time for people who are grieving or have challenging relationships with their family. It’s always good to remember to be extra kind and understanding during this time, Levonis said.

Boz also recommends cutting costs by being selective in your expenses. For example, when it comes to hosting, hosting even a small group of people can be very expensive if you’re expected to pay for everything. If you’re in this situation, you might propose that everyone bring a dish.

“Maybe try a potluck or if you want to control the dinner menu, allow people to bring appetizers and drinks or dessert,” she said.

communicate your feelings

If you are experiencing financial difficulties, talking about it with your family and friends may help.

Liu, who was diagnosed with anxiety and depression during her first year as a medical resident, now feels more comfortable talking with her family after keeping her struggles to herself for six months.

“I am of Chinese ethnicity and in our culture it is very stigmatizing to talk about mental health,” Liu said.

Her parents and twin sister helped her through difficult times, and her father shared that he struggled with showing emotions when he was growing up and that he wishes his generation could be more open.

don’t be afraid to say no

This is the season where social events are happening every weekend, but if it’s causing you too much financial stress or harming your mental health, it’s okay to be selective.

Additionally, if you start to feel uncomfortable having certain conversations with your family, Levonis recommends taking breaks and limiting your alcohol consumption.

adopt a healthy routine

Although your stress may stem from financial struggles, negative feelings may spill over into other aspects of your life, making it harder to enjoy the holidays.

Levonis recommends taking some time away from social gatherings and Christmas shopping to do something for yourself, like exercising.

“Prolonged low-intensity activities seem to be most helpful,” said Levonis, who suggested long walks or bike rides in nature.

Getting enough sleep is also important. It can be a good practice to turn off your electronics a few hours before bed.

Get professional help if you need it

If you are experiencing mental health issues, there are many resources you can use to get professional help.

In the US, you can dial 211 to speak confidentially and for free to a mental health professional.

Other mental health resources include:

Veterans Crisis Line: Call 1-800-273-TALK (8255)

Crisis Text Line: Text the word ‘HOME’ to 741-741

Trevor Lifeline for LGBTQ youth: 1-866-488-7386

Trans Lifeline: 1-877-565-8860

A version of this story was moved to December 2022. This story has been updated with new details and citations.

The Associated Press receives support from the Charles Schwab Foundation for educational and explanatory reporting to improve financial literacy. The independent foundation is separate from Charles Schwab & Co. Inc. AP is fully responsible for its journalism.

Copyright 2023 The associated Press, All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

[ad_2]

Source link