[ad_1]

WASHINGTON (AP) — Ignoring higher interest rates, U.S. consumers spent enough to help drive the economy a brisk 5.2% pace from July to September, the government said Wednesday, upgrading from its previous estimate. told.

The government had earlier estimated that the economy grew at a 4.9% annual rate in the last quarter.

The second estimate of growth for the July-September quarter on Wednesday confirmed that the economy has accelerated rapidly Rate of 2.1% from April to June, It showed that America’s gross domestic product – the total output of goods and services – grew at the fastest quarterly rate in almost two years.

Consumer spending, the lifeblood of the economy, grew at a 3.6% annual rate from July to September – still healthy but below the previous estimate of 4%. Private investment grew at a 10.5% annual pace, including a 6.2% increase in housing investment, which defied high mortgage rates.

The economy also got a boost from companies building inventory in anticipation of future sales, adding 1.4 percentage points to quarterly growth. The third quarter’s growth also included increased spending and investment by governments at all levels – federal, state and local.

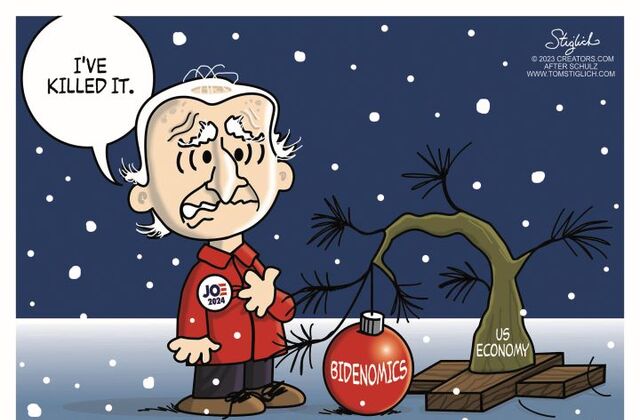

political cartoon

The US economy, the world’s largest, has proven to be as resilient as the Federal Reserve Raised its benchmark interest rate 11 times To fight the worst inflation battle in four decades from March 2022. Those higher interest rates have significantly increased consumer and business borrowing costs. But they have also helped reduce inflationary pressures: Consumer prices rose 3.2% last month Compared to 12 months ago, there is a significant improvement from the 9.1% year-on-year inflation recorded in June 2022.

The combination of subdued inflation and flexible appointments has raised hopes that the Fed can manage a so-called soft landing – raising rates enough to cool the economy and control price increases without plunging the economy into recession.

“We anticipate a continued expansion in economic activity, but the pace should be significantly slower in the current fourth quarter,” said Rubeela Farooqui, chief U.S. economist at High Frequency Economics. “We expect a decline in household spending.” , not just on the unusually strong third quarter payout, but also on the cumulative effects of monetary policy tightening.”

Copyright 2023 The associated Press, All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

[ad_2]

Source link