[ad_1]

Pending home sales were unchanged in November as sales declines in the formerly hot South outweighed small gains in the Northeast and Midwest.

The National Association of Realtors’ pending home sales index, a key indicator that tracks contract signings that typically precede a subsequent sale by a month or two, rose 0.8% in the Northeast and 0.5% in the Midwest. . However, the South recorded a decline of 2.3%. Overall, transactions were down 5.2% from a year earlier.

As the year comes to an end, the housing market is showing some signs of revival. Analysts are expecting a recovery in sales in 2024 due to falling mortgage rates.

“Although the decline in mortgage rates did not prompt more home buyers to submit formal contracts in November, it did increase interest, as shown by the greater number of lockboxes opened,” said Lawrence Yun, chief economist at NAR. Is.”

“A further decline in mortgage rates in December – a savings of about $300 a month from the recent cyclical peak in rates – should lead to a recovery in home sales in 2024,” Yoon said.

House prices There was an annual increase of 4.8% in OctoberA 4% gain in September and the highest rate in 2023 is coming. The decline in mortgage rates from a peak of 8% and an improvement in the inventory of homes for sale are helping sales. Still, the housing market remains far short of the number of homes needed to meet demand, a factor that is keeping prices high.

“Buyers have turned to new construction over the past year as existing home supply has been limited and builders have been eager to encourage purchasing with low rates,” said Danielle Hale, chief economist at Realtor.com. “An uptick in new listing activity among existing homes, which boosted overall inventory in November, led to a decline in mortgage rates and an improvement in pending sales activity, fueling buyer interest in existing homes.”

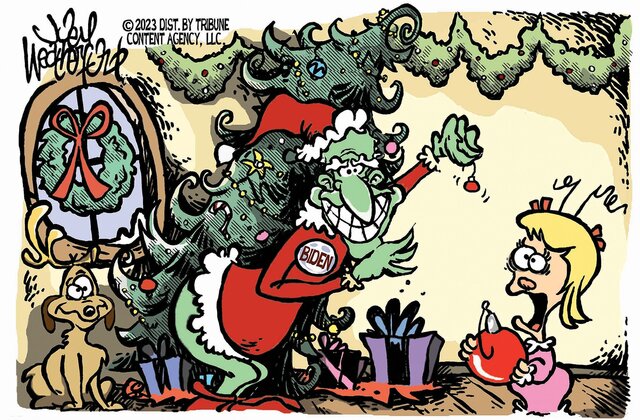

political cartoon on economy

Also on Thursday, the number of Americans filing first-time claims for unemployment benefits rose 12,000 to 218,000 from a revised 206,000 a week earlier. The four-week moving average was 212,000, down 250 from the previous period.

As 2023 comes to an end, economic data is coming in that generally shows growth in the economy. The next two weeks will bring reports on the labor market and inflation, but they will still be for the last months of 2023. Economists are generally expecting the economy to soften but avoid recession in 2024 or, if it does, it will be a mild one.

[ad_2]

Source link