[ad_1]

NEW YORK (AP) — Donald Trump could potentially be ordered to “disintegrate” his real estate empire for repeatedly making misrepresentations on financial statements to lenders in violation of New York’s powerful anti-fraud law.

But an Associated Press analysis of similar cases spanning nearly 70 years shows that Trump’s case is different: It is the only big business that was threatened with closure without showing obvious victims and major losses.

Some legal experts worry that if a New York judge moves forward with such a penalty in a final ruling expected by the end of this month, it would make it easier for courts to wipe out companies in the future.

“It sets a terrible precedent,” said Adam Leitman Bailey, a New York real estate lawyer who once sued a Trump condo building.

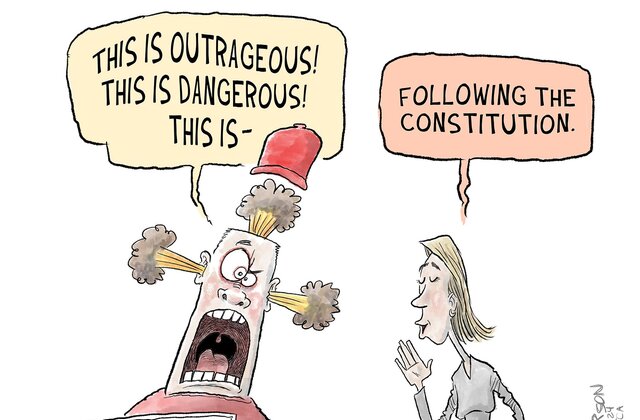

political cartoon

Trump’s case stuck

The New York statute, known as Executive Law 63(12), does not require any misrepresentation or lying that results in someone being defrauded or deprived of money to be found to be a fraud. Loss occurs. But an AP review of nearly 150 cases reported in legal databases found that victimization and harm were major factors in dozens of cases seeking “dissolution.”

An AP review found that a breast cancer nonprofit was shuttered a dozen years ago because it paid for the director’s salary, perks and other expenses instead of free mammograms, research and support for survivors as promised. Had used all of his $9 million in donations to pay for it.

A private equity firm that boasted of huge investment success shuts down after stealing millions of dollars from thousands of investors.

And a mental health facility was closed down for looting $4 million of public funds while neglecting patients.

Other businesses shut down include a fake psychologist who sold questionable treatments, a fake attorney who sold false claims that he could get students into law school, and businessmen who marketed financial advice but instead People were thrown out of their household chores.

There may be more dissolved companies than AP. Legal experts caution that some 63(12) cases never appear in legal databases because they were settled, dropped or otherwise not reported.

Still, the only case the AP found of dissolving a business under anti-fraud law without citing actual victims or losses was a relatively small company shut down in 1972 for writing term papers for college students. In that case, the Attorney General said the victim was “the integrity of the educational process.”

What did the judge say about Trump?

New York Supreme Court Justice arthur engron Last year Trump had given the decision commit fraud In sending 11 years of allegedly inflated estimates of his net worth to Deutsche Bank and others. New York Attorney General Letitia James, who filed the lawsuit, said it helped the former president get lower interest rates.

Among Trump’s many false claims was that he allegedly defrauded a bank: His penthouse apartment was described as three times larger than its actual size.

But if the fraud is obvious, there will be no impact.

Banks and others have not complained, and it is unclear how much they lost, if anything.

“It’s basically a death sentence for a business,” Columbia University law professor Eric Talley said of Trump’s possible closure. “Is he only getting sweets because of fraud, or because people don’t like him?”

The judge’s “dissolution” decision last year is being appealed.

Attorney General’s version

James called a loan expert, who estimated that Deutsche Bank left $168 million in excess interest on its Trump loans, based on his calculations as if Trump had never offered a personal guarantee.

But Trump offered guarantees, even though estimates of his personal wealth were exaggerated.

In fact, the bank made its own estimates of Trump’s personal wealth, sometimes reducing Trump’s figures by billions of dollars, and still decided to grant him the loan. And bank officials called to testify couldn’t say with certainty whether Trump’s personal values statements had any impact on rates.

How will ‘Disintegration’ work?

The judge said last year that the state certifications needed to run many of Trump’s New York companies should be revoked and the companies should be turned over to a receiver who would manage their “dissolution.”

What the judge left unclear is what he meant by “dissolution”, whether that referred to the liquidation of the companies that controlled the assets or the assets themselves.

In the worst case, as interpreted by legal experts, Angéron could decide the means of dissolution. Isolating real estate mogul Not only his New York holdings such as Trump Tower and his 40 Wall Street skyscraper, but also his Mar-a-Lago Club in Florida, a Chicago hotel, and other properties.

Notably, Attorney General James never called for a dissolution and sale.

instead. He has recommended that Trump be banned from doing business and paying in New York $370 millionWhat she estimates is residual interest and other “misearned earnings.”

In a footnote in a 94-page summary document filed earlier this month, James suggested that the judge appoint an independent monitor to oversee Trump’s conduct for five years, after which the court could decide whether Should his business certificate be revoked and possibly put him out of business. ,

University of Michigan law professor William Thomas says he’s worried the order could stand.

“Those who want to see Donald Trump suffer in any way risk losing sight of the commitment to the rule of law that they accuse him of violating,” he said.

Copyright 2024 The associated Press, All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

[ad_2]

Source link