[ad_1]

TOKYO (AP) — Asian shares rose Thursday as Wall Street hit a record high as Tokyo’s benchmark neared its highest level since 1990.

The benchmark Nikkei 225 rose 1.8% to 35,053.67 in afternoon trading as the yen weakened against the US dollar, boosting export-related shares in their New Year’s rally.

Toyota Motor Corp shares rose more than 3%, while Honda Motor Co shares rose 2.5%. Sony Group Corp rose 3.4% and Hitachi rose 4%. Analysts said profit-booking is likely to keep profits under control going forward.

Hong Kong’s Hang Seng rose 1.3% to 16,302.04, while the Shanghai Composite rose 0.3% to 2,886.65.

Australia’s S&P/ASX 200 rose 0.5% to 7,506.00. South Korea’s Kospi slipped less than 2 points to 2,540.27.

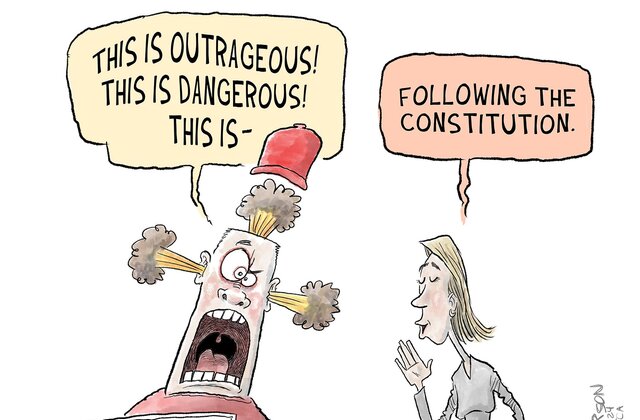

political cartoon

The South Korean central bank kept its monetary policy unchanged at a policy meeting as inflation remains above the 3% threshold.

“Growth remains relatively good with a recent recovery in semiconductor exports,” Robert Carnell, regional head of Asia-Pacific research at ING, said in a report.

Stocks rose on Wall Street Wednesday as traders made their final moves ahead of a report on inflation on Thursday that could show whether all the excitement driving stocks to records is justified.

The S&P 500 rose 0.6% to 4,783.45, just 0.3% shy of its all-time high. The Dow Jones Industrial Average rose 0.5% to 37,695.73 and the Nasdaq Composite climbed 0.8% to 14,969.65.

price increases it has become cold Since they peaked in the summer of 2022, expectations grew that the Federal Reserve could cut interest rates sharply this year.

Economists expect Thursday’s report to show that prices paid by U.S. consumers in December were 3.2% higher than a year earlier, according to FactSet. That would be slightly faster than November’s 3.1% inflation rate. But after ignoring the effects of food and fuel prices, which can change sharply from month to month, economists believe the underlying inflation trend is likely to be subdued.

The Fed has hinted at possibly cutting interest rates three times this year. Many traders are expecting a double rate cut, but critics say that is overly optimistic.

The yield on 10-year Treasuries has already fallen well below its level above 5% in October due to strong expectations of a rate cut. It rose slightly more on Wednesday, rising to 4.03% from 4.02% late Tuesday.

On Wall Street, Boeing’s stock steadies after falling early next week explosion in flight One of his planes flying for Alaska Airlines. It increased by 0.9%.

The largest companies in the S&P 500 are set to begin reporting their results for the last three months of 2023 on Friday. Delta Air Lines, JPMorgan Chase and UnitedHealth Group will be among the day’s headliners.

Analysts estimate a half-dozen stocks were responsible for most of the S&P 500’s rise last quarter. But according to Bank of America strategists the trends are improving slightly. He says 66% of companies are expected to report profit growth, up from 64% in the third quarter.

“Although risks still remain, fundamentals are improving and analysts seem more optimistic than in the summer,” Ohsung Kwon and Savita Subramanian said in a BofA Global Research report.

Some of Wall Street’s biggest losses on Wednesday came from stocks of oil-and-gas companies. Exxon Mobil dropped 1%, and Devon dropped 1.9%.

Benchmark U.S. crude rose 50 cents to $71.87 a barrel early Thursday. It fell 87 cents to $71.37 on Wednesday. Brent crude, the international standard, rose 58 cents to $77.38 a barrel.

In cryptocurrencies, Bitcoin was swinging around $46,000 shortly after the Securities and Exchange Commission said it would allow trading. Exchange-Traded Funds That Hold Actual BitcoinRather than just the futures contracts related to them.

The SEC appeared deeply divided on this decision. One commissioner called it an overdue step to give investors the ability to express their views on Bitcoin, while another described it as an unfair action that “took us down a wrong path that could harm investor protection and “Could cause more damage.”

The US dollar fell to 145.34 JPY from 145.76 yen. The euro has risen from $1.0972 to $1.0976.

Copyright 2024 The associated Press, All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

[ad_2]

Source link