[ad_1]

TOKYO (AP) — Asian shares fell Monday as investors awaited updates on consumer spending and inflation in the United States and other countries.

Japan’s benchmark Nikkei 225 fell 0.4% to 33,479.71 in morning trading after the producer price index for October came in slightly higher than expected, up 2.3%.

Industrial profits in China fell by minus 7.8% in October compared with a year earlier.

“Although conditions are improving, it also indicates that the recovery is slow. “Judging by the recent series of economic data, the pace of the recovery is also becoming intermittent,” IG market analyst Yep Jun Rong said in a note.

Hong Kong’s Hang Seng fell 1.0% to 17,382.28, while the Shanghai Composite fell 0.8% to 3,017.79.

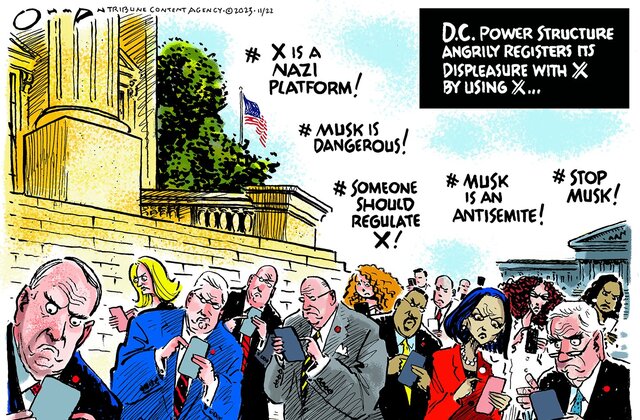

political cartoon

Australia’s S&P/ASX 200 fell 0.4% to 7,009.50. South Korea’s Kospi fell 0.2% to 2,491.20.

Several central banks in the region are holding policy meetings this week, including the Reserve Bank of New Zealand, the Bank of Korea and the Bank of Thailand. While analysts expect them to turn their backs on policy, the focus will remain relatively high given concerns about inflation.

Wall Street finished mixed last week with a half-day trading session that concluded its fourth consecutive winning week. The holiday shopping season has started black Friday Amid concerns that spending may slow due to declining savings, rising credit card debt and inflationary pressures.

On Friday, the S&P 500 rose 0.1% to 4,559.34 and the Dow Jones Industrial Average rose 0.3% to 35,390.15. The Nasdaq Composite slipped 0.1% to 14,250.85, as gains in the health care and financials and energy sectors offset losses in technology stocks.

Trading was slow on Thursday when the market reopened after the Thanksgiving holiday. Gains in health care, financial, energy and other sectors helped offset losses in technology and communication services stocks.

Chipmaker Nvidia and Google parent Alphabet were the biggest decliners, falling 1.9% and 1.3% respectively. Big gainers on the S&P 500 included CF Industries, which rose 2.6%, and Best Buy, which closed 2.2% higher.

The latest weekly gains for major stock indexes reflect a turnaround in market sentiment in November after three months of decline. Traders have become cautiously optimistic that inflation has eased substantially federal Reserve This would ultimately be accompanied by a market-threatening increase in interest rates.

The Fed will get another big update this week when the government releases its October report for the key inflation measure tracked by the central bank.

In other trading early Monday, the yield on the 10-year Treasury, which influences interest rates on mortgages and other loans, rose to 4.50% from 4.47%.

Benchmark U.S. crude fell 66 cents to $74.88 a barrel in electronic trading on the New York Mercantile Exchange. On Friday it fell by $ 1.56 to $ 75.54 per barrel.

Brent crude, the international benchmark, fell 62 cents to $79.86 a barrel.

The US dollar fell to 148.96 JPY from 149.53 yen. The euro is priced at $1.0945, little change from $1.0944.

Copyright 2023 The associated Press, All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

[ad_2]

Source link