[ad_1]

Asian shares fell on Wednesday after Wall Street predicted a bearish start to 2024, giving back some of last year’s powerful gains.

US futures were lower and oil prices were little changed.

Hong Kong’s Hang Seng fell 1% to 16,618.50, hit by a 2% decline in technology shares, while the Shanghai Composite Index rose 0.1% to 2,966.13.

Prices of Chinese gaming companies rose, with Tencent Holdings and NetEase both rising more than 1% after local reports said a senior official responsible for overseeing China’s gaming industry had been sacked. Release of Draft Regulations Last month, gaming stocks fell just days before Christmas.

Australia’s S&P/ASX 200 slipped 1.4% to 7,523.20. South Korea’s benchmark fell 2.3% to 2,607.31 after hitting a 19-month high on Tuesday amid a short-selling ban.

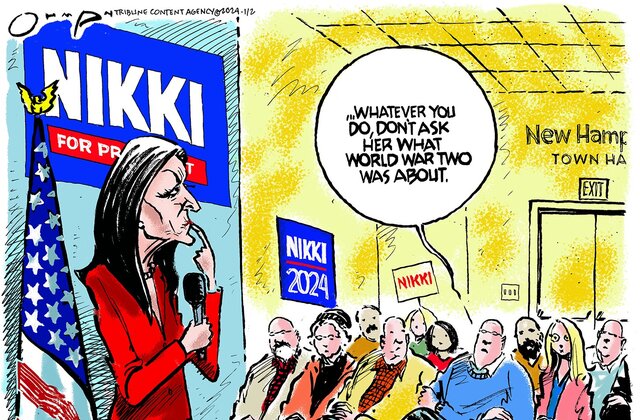

political cartoon

Bangkok’s SET fell less than 0.1% and India’s Sensex was down 0.4%.

Japanese markets remained closed due to New Year holidays.

On Wall Street on Tuesday, the S&P 500 slipped 0.6% to 4,742.83 after hitting an all-time high for the year.

The Dow Jones Industrial Average rose 0.1% to 37,715.04 and the Nasdaq Composite dropped 1.6% to 14,765.94.

Some of the market’s sharpest declines came from stocks that were last year’s biggest winners. Apple lost 3.6% in its worst day in nearly five months, and Nvidia and Meta Platform both fell more than 2%. TeslaAnother member of the “Magnificent 7” Big Tech stocks that drove more than half of Wall Street’s returns last year was swinging between losses and gains after reporting its deliveries and production for the end of 2024. The day ended with a decline of less than 0.1. ,

Netherlands-based ASML sank when the Dutch government partially revoked its license to ship some products to customers in China. The United States is pushing to ban the export of chip technology to China. US-listed shares of ASML fell 5.3%, and US chip stocks also weakened.

Health care stocks outperformed after Wall Street analysts upgraded the ratings of some stocks, including a 13.1% rise for Moderna. Amgen’s 3.3% gain and UnitedHealth Group’s 2.4% gain were two of the strongest forces lifting the Dow.

Investors were bracing for a break in the big rally that brought the S&P 500 to nine consecutive winning weeks and to within 0.6% of its record set nearly two years ago. This huge surge was based on the expectation that the Federal Reserve would have planned to avoid high inflation smartly: where high interest rates slow the economy enough to reduce inflation, but not so much that they cause a painful recession. Become.

A report on Tuesday showed that the US manufacturing industry may be weaker than anticipated. According to S&P Global, preliminary readings indicated it fell more than previously expected last month as weakness abroad and domestically weighed on new sales. However, business confidence reached a three-month high.

A separate report showed that construction spending growth slowed somewhat more than economists expected in November.

Like stocks, Treasury yields in the bond market also fell slightly on Tuesday after a big rally since the autumn. The yield on the 10-year Treasury rose to 3.94% from 3.87% late Friday.

There will be more high-profile reports on the economy later this week. On Wednesday, the Federal Reserve will release minutes of its last policy meeting, raising hopes of a rate cut this year.

Another report on Wednesday will show how many job openings U.S. employers were advertising at the end of November, data the Federal Reserve closely follows. On Friday, the US government will bring monthly data of job growth across the country.

In other trading, U.S. benchmark crude oil fell 2 cents to $70.36 a barrel in electronic trading on the New York Mercantile Exchange. Brent crude, the international benchmark, fell 4 cents to $75.85 a barrel.

The US dollar rose to 142.11 JPY from 141.99 yen. The euro rose to $1.0959 from $1.0936.

Copyright 2024 The associated Press, All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

[ad_2]

Source link