[ad_1]

Payroll firm ADP said Wednesday that private employers added 103,000 jobs in November in another sign that the labor market is returning to a more normal pace.

The number compares to a revised forecast of 106,000 and 130,000 increases added in October.

The gains came mostly in the services sector, where 117,000 jobs were added, about half of which were in the trade, transportation and utility industries. Leisure and hospitality, a key driver of job growth for most of last year, shed 7,000 jobs. Medium-sized companies, those with 50 to 249 employees, were responsible for 71,000 new jobs.

Meanwhile, average wages grew at an annual rate of 5.6%, the lowest pace since September 2021, although well above current levels of inflation.

“Restaurants and hotels were the largest job creators during the post-pandemic recovery,” said Nella Richardson, ADP’s chief economist. “But that boost is behind us, and the trend reversal in leisure and hospitality suggests the economy as a whole will see more moderate hiring and wage growth in 2024.”

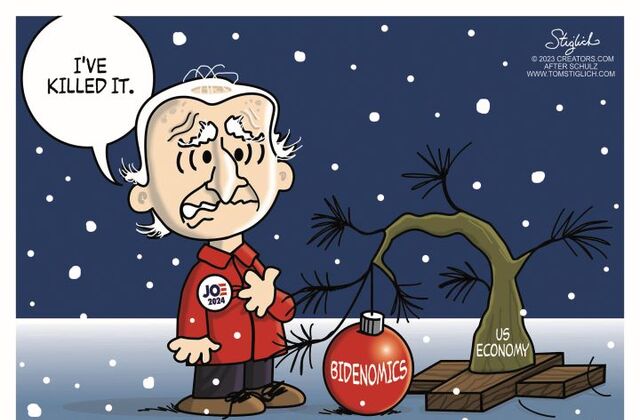

political cartoon on economy

The ADP report comes after the Labor Department on Tuesday released job openings numbers for October, which showed a decline of 9.35 million to a revised 8.7 million in September. However, hiring and layoff levels were stable, suggesting that the decline was due to employers cutting their estimates of potential hiring.

Nevertheless, the picture is of the labor market returning to a more normal balance between supply and demand.

“Overall, we have the lowest job openings we’ve seen in some time, but there are still more jobs than job seekers,” says Haley Dam, head of workforce planning at Adecco US. “It’s been getting a little softer and cooler over the last few months.”

Balancing the labor market is an important factor the Federal Reserve is looking for as it seeks to drive inflation out of the economy. That effort is working, but the inflation rate is still above the 2% annual target set by the Fed. The central bank will meet next week to consider the level of interest rates, but most analysts believe it will keep rates unchanged for now as it has done with raising them for the current cycle.

“The labor market is slowly loosening and softening,” says Julia Pollack, chief economist at ZipRecruiter. As for the Fed, she adds, “I still think it’s going to be a stable few months But I think we could see a rate cut as early as March.”

This is still a debate among economists whether there will be a recession in the economy next year.

“It’s a bit of a mixed time,” says Sevyn Yeltekin, dean of the Simon Business School at the University of Rochester.

That’s because economic data shows both weakness and strength depending on the sector of the economy and whether it’s looking backward or forward, Yeltekin says, “I’m probably a little optimistic.”

On the inflation front, energy costs – a key component of the overall price picture – continue to decline from levels earlier this year. Gasoline prices fell another four cents this week to a national average of $3.21, the 11th consecutive week of decline. Meanwhile, oil for West Texas crude is trading at $72 per barrel.

The yield on 10-year Treasuries has fallen to 4.2% from nearly 5% in mid-October.

[ad_2]

Source link