[ad_1]

Markets went into a holiday frenzy after the Federal Reserve signaled it would effectively end raising interest rates last week.

This week will show whether the Fed’s call was right as a series of macroeconomic data covering housing, consumer sentiment and inflation will paint a good picture of how the economy is ending the year.

The main highlight will likely be the release on Friday of the personal consumption expenditure price index for November. The inflation measure is a favorite of Fed Chairman Jerome Powell and other central bank officials, although it is much less well-known than the monthly consumer price index.

Both overall PCE and the core index that excludes food and energy costs are expected to decline slightly for the month and year, with the annual rate reaching 2.7%. This is still above the Fed’s 2% annual target but shows a declining trend.

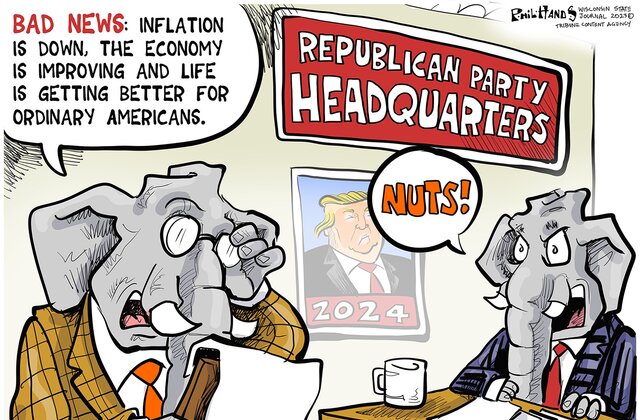

political cartoon on inflation

“On net, net, there is not much inflation in the pipeline at the producer level because the supply shocks of the pandemic are long gone,” said Chris Rupkey, chief economist at FWDBonds.

“Producer prices look weak as factories ramp up manufacturing output

The struggle continues,” he added. “Company officials have now consistently said that manufacturing is in recession. The only conclusions Fed officials can draw

The vote on policy is that there is no inflation at the productive level and that makes it even more likely that they can get inflation down to a soft landing without bringing the economy to its knees and creating the massive job losses that occur in every recession. Will bring.

There will also be fresh data on the November housing market, with building permits and reports starting on Tuesday, followed by existing home sales on Wednesday. The sale of the new home is scheduled to take place on Friday. In recent months, sales of new homes have been strong while sales of existing homes have been hurt by the lack of available inventory.

The data will cover the period before the recent sharp decline in mortgage rates, which brought the rate on a 30-year fixed-rate loan to about 7% as of Friday. Mortgage rates fell after bond yields fell in response to the Fed’s decision on interest rates. This led to a 4% increase in demand for mortgages to purchase new homes and a 19% increase in refinancing.

The end of the week brought an update on consumer mood from the University of Michigan. Two weeks ago, consumer sentiment rose 13% over preliminary estimates, erasing a four-month decline Expressed greater approval towards present and future conditions. Inflation expectations have fallen sharply to 3.1% from 4.5% a month ago. This is the lowest level since March 2021.

Gasoline prices have fallen in recent weeks, hovering near or below $3 a gallon in many states, while incomes are rising as wages are increasing at a rate above inflation. This is likely to give consumers enough strength to make a good holiday shopping season.

“As 2023 comes to a close, it is becoming clear that the economy not only avoided the widely anticipated recession, but it also had a great year for the economy. Real GDP is on track for rapid growth of 2.5%, unemployment remains below 4%, and inflation has declined sharply, Mark Zandi, chief economist at Moody’s Analytics, posted on social media.

While Powell declined to say whether the Fed might actually lower rates at his press conference, the central bank did upgrade its economic and inflation forecasts for next year and beyond. Gross domestic product for the fourth quarter was revised upward to 2.6% annual growth from 2.1% previously, while economic growth is projected at 1.4% in 2024.

The Fed estimates overall inflation will reach 2.4% by the end of 2024.

Overall, the Fed may also have something to celebrate.

[ad_2]

Source link