[ad_1]

FRANKFURT, Germany (AP) — Inflation in Europe rose to 2.9% in December, rising again after seven consecutive monthly declines as food prices rose and support for higher energy bills ended in some countries. Rising price levels are casting doubt on bullish forecasts Interest rates cut by European Central Bank,

The figure released on Friday was above this 2.4% annual inflation recorded in November – but well below the peak of 10.6% in October 2022.

ECB President Christine Lagarde warned that inflation could move away from its recent decline and rise in the coming months. The central bank of the 20 European Union countries that use the euro currency raised its benchmark interest rate to a record-high 4% and said it would wait as long as necessary to push inflation down to its target of 2%. This will be considered the best. For the economy.

The faster-than-expected decline in inflation in the final months of 2023 has led some analysts to predict that the central bank will start cutting interest rates as early as March.

December’s rebound in inflation supports analysts who are predicting that rates will not begin to decline until June.

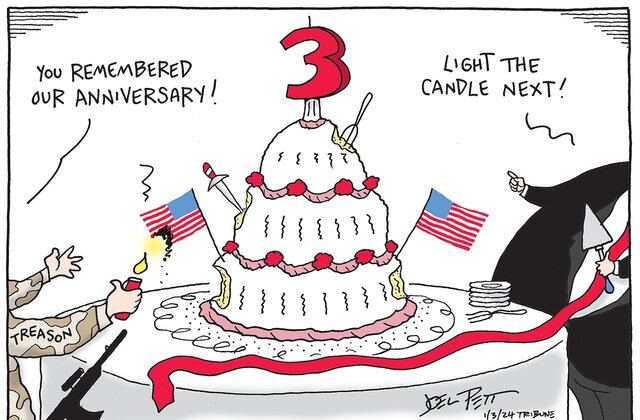

political cartoon

Carsten Brzeski, chief eurozone economist at ING Bank, said inflation rose to 3.8% from 2.3%. Germany, Europe’s largest economy“Reinforces the stance of keeping a very steady hand and not rushing into any rate cut decisions.”

US Federal Reserve officials also stressed the importance of keeping rates high until inflation “significantly goes down” Minutes of their meeting of 12-13 December Released on Wednesday. The Fed has indicated three rate cuts this year.

Higher interest rates are the typical central bank tool against inflation. They increase the cost of borrowing for consumer purchases, especially homes and apartments, and business investment in new offices and factories.

That reduces demand for commodities and puts downward pressure on prices – but it could limit growth at a time when Europe is in short supply. The economy shrank by 0.1% In the July-to-September quarter.

However, inflation itself has been a major challenge to economic growth as it takes away the purchasing power of consumers. The ECB – like other central banks around the world – said raising rates quickly was the best way to get it under control and avoid even more drastic measures later.

Core inflation, which excludes volatile fuel and food prices, eased to 3.4% in November from 3.6%, according to EU statistics agency Eurostat. The ECB is keeping a close eye on this figure.

Inflation soared in Europe as the COVID-19 pandemic reduced supplies of parts and raw materials, then in February 2022 Russia invaded Ukraine, increasing food costs And energy.

Copyright 2024 The associated Press, All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

[ad_2]

Source link